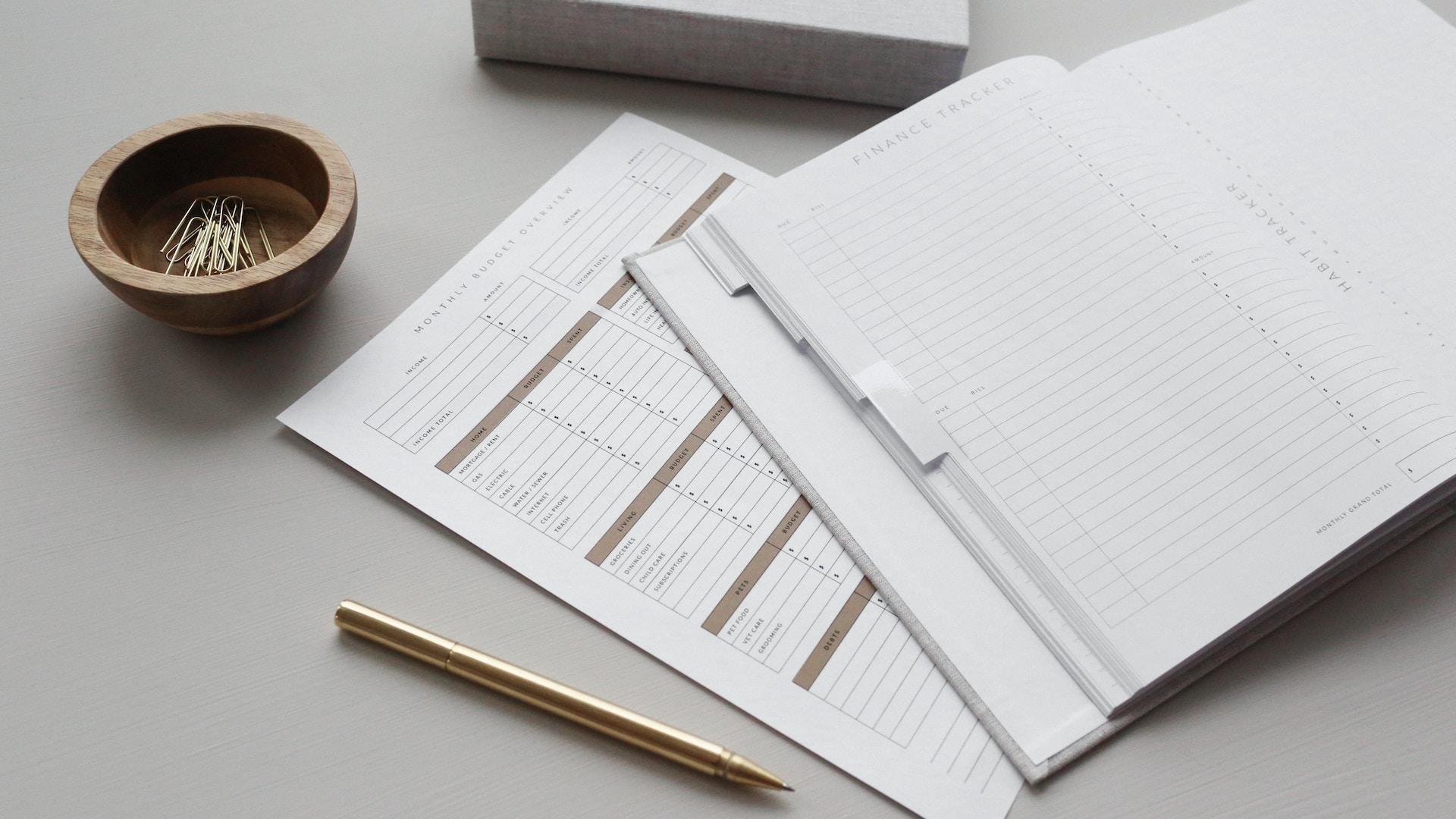

A balance sheet is a type of financial statement that gives an overview of a company’s finances at a certain point in time. It is a key document for investors, lenders, and other stakeholders who want to understand a company’s financial health. Here are some steps for reading a balance sheet:

- Understand the structure of the balance sheet: The balance sheet has three sections: assets, liabilities, and equity. The assets section lists everything a company owns that has value, such as cash, inventory, and property. The liabilities section lists everything a company owes, such as loans and accounts payable. When all of the company’s debts are subtracted from its assets, the value of the company is shown in the equity section.

Analyze the assets section: Check out the section on assets to find out what a company owns and how much it is worth. Usually, assets are listed in order of how quickly they can be turned into cash, with cash and cash-like assets at the top. This section will also have information about long-term assets like property, plant, and equipment, as well as any intangible assets like patents or trademarks.

- Look at the section on liabilities: The liabilities section lists everything a company owes, such as loans, accounts payable, and taxes owed. Usually, liabilities are listed in the order of when they are due, with the ones that are due soonest at the top. This section will also have information about loans and bonds, which are long-term debts.

- Analyze the section on equity. The section on equity shows how much the company is worth when all of its liabilities are subtracted from its assets. This section will have details about any common or preferred stock, as well as any retained earnings.

- Check out the numbers: Ratios can give you more information about a company’s finances. The debt-to-equity ratio shows how much a company owes compared to how much it has in equity. The current ratio shows how well a company can pay its short-term debts with its current assets.

- Compare balance sheets from different time periods to see how a company’s finances have changed over time. This can help you understand trends and spot potential problems.

- Think about outside factors: A company’s finances can also be affected by things like the economy and changes in the industry. Consider these things when looking at a company’s balance sheet to learn more about its financial health.

Overall, reading a balance sheet requires knowing about money, being able to analyse the information given, and taking outside factors into account. Investors and other stakeholders can make better decisions about a company’s financial health if they follow a plan and use ratios and comparisons to learn more.